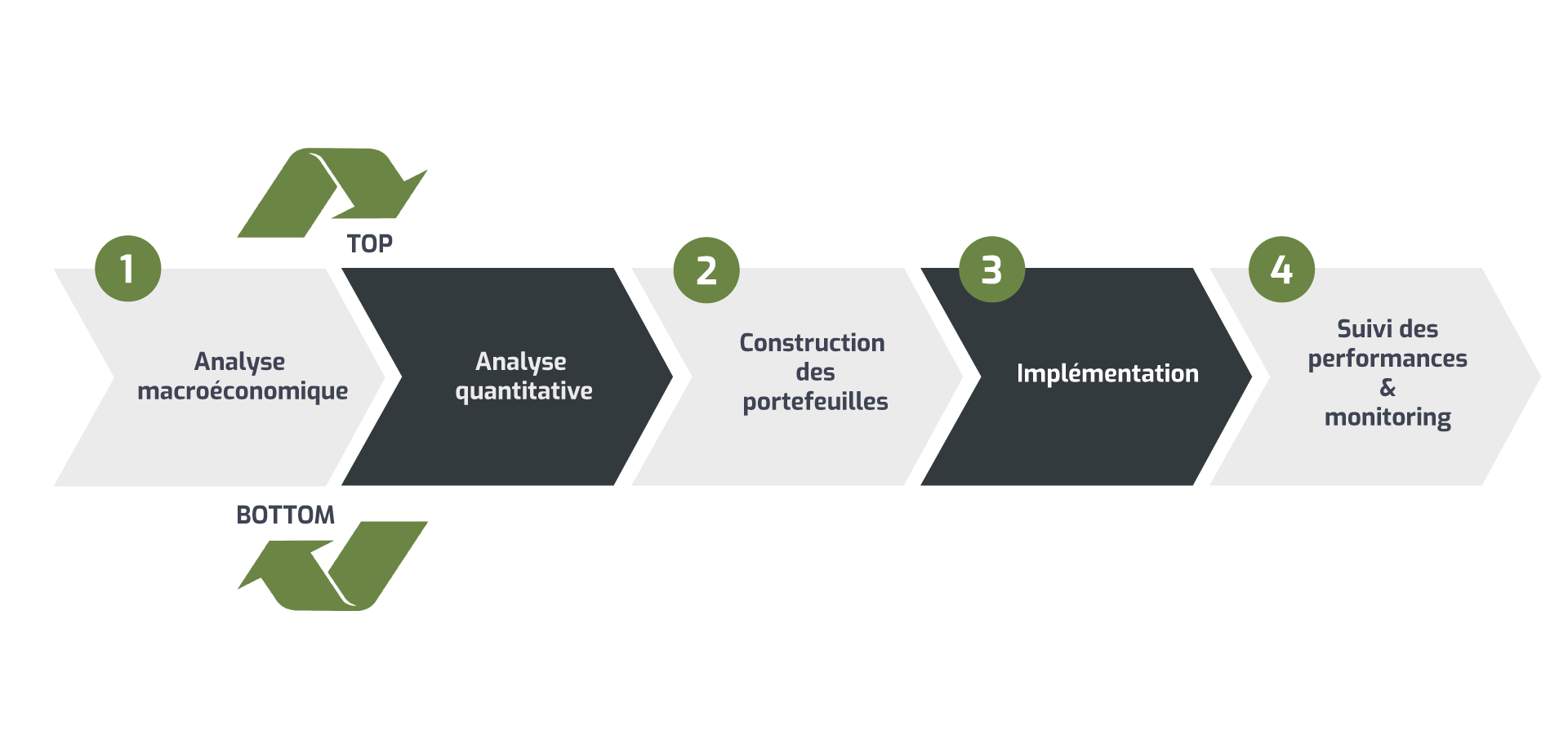

Management process

Our investment approach is based on a fundamental analysis of the macroeconomic context and markets. The construction of the model portfolio is the result of both our expectations, regulatory constraints and specific customer.

Bond management

- Through a macroeconomic and market analysis, our analysts and managers draw a global vision according to the strategic orientations of the investment committee. They analyze macroeconomic indicators (growth rate, inflation, monetary policy, fiscal policy, trade balance, etc.). They refer to research cell studies and business reports

- After the fundamental and market analysis, our experts proceed to the quantitative study of the segments of the yield curve. The analysis is confronted with the scenario of fundamental evolution of the rates to give the global orientations of the curve.

- The determination of the investment horizon (target life) initiates the construction of the target portfolio. The quantitative analysis of the yield curve allows our specialists to allocate this duration on the different segments of the curve. The target portfolio establishes the efficient frontier according to the amount of risk tolerated by the investor and the expected level of return. This model portfolio reflects the fund's performance strategy. It is reviewed quarterly.

- The manager represents the actual portfolio according to the target portfolio's orientations in terms of "strata bets". It adapts to its constraints (liquidity of the securities, change of the liabilities of the fund ...). Purchase and sale proposals are executed according to the opportunities on the primary and secondary markets

.

Equity Management

- Our teams analyze macroeconomic and sectoral indicators in order to anticipate the impact on the issuer's results. Managers build a solid argument that leads to convictions by sector and value.

- In collaboration with the By-side Analysis Department, the Management team builds valuation models by value. These models make it possible to establish a valuation range by title and to study the sensitivity of the values to the risk factors. This approach streamlines the adjustment of the target portfolios.

- The implementation of model portfolios is based on a selection of securities based on prior fundamental analysis (strategic information and events, financial results, market and value valuation ratios, opinion by value, visit and interview with the management of listed companies , participation in general meetings, etc.) coupled with a market analysis (supply and demand, liquidity, etc.). This analysis leads to target portfolios adapted to the regulatory constraints and specificities of each fund (size, horizon, risk aversion, nature of liabilities)

- The negotiation of the order book by our specialists optimizes the market timing, while respecting the price ranges fixed by the Management.

- After the implementation, our managers monitor the performance of the funds. A weekly dashboard, prepared by the reporting entity, presents the performance of each fund relative to its benchmark and its competitors, as well as the attribution of its performance. The monthly performance of the equity pockets is analyzed in monitoring committees to improve the implementation of the portfolios and adjust the bets.